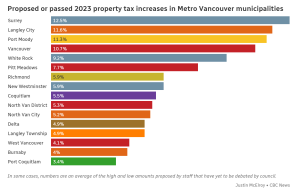

Here’s a quick tour around BC and how much various municipalities are raising their property taxes by in 2023.

Vancouver

2023 Property Tax Increase: 10.7%

Status: Approved

During his election campaign, Mayor Ken Sim had stated that a 10% property tax increase would not be sustainable. However, in March, the City of Vancouver approved a 10.7% property tax increase, surpassing the originally proposed 9.7% rate, due to a last-minute amendment introduced by Mayor Sim himself. This increase provided additional funding for the Vancouver Police Department, which was not included in the 9.7% version of the 2023 Budget.

Despite this, the City of Vancouver is introducing a new Development Potential Relief Program that aims to provide property tax relief for small businesses. This program reduces the tax burden for businesses that are paying inflated property taxes due to the development potential of their land.

Surrey

2023 Property Tax Increase: 12.5%

Status: Approved

Surrey is facing a substantial property tax increase due to the need for increased funding for policing. However, unlike Vancouver, Surrey’s proposed tax hike is due to the city having to pay for two police forces instead of one. This is a result of the city’s decision to halt the transition to the Surrey Police Service and retain the Surrey RCMP.

Originally proposed at 17.5%, the property tax hike is now reduced to 12.5% following the provincial government’s announcement of the Growing Communities Fund along with its budget. The fund will provide Surrey with $89.9M to add to its budget, which will help decrease the necessary tax rate increase.

Langley City

2023 Proposed Tax Increase: 11.56%

Status: Pending Approval

In a council meeting on March 6, Langley City approved its budget, which reportedly had a gap of $3,863,160 between the total revenues and planned expenditures. To balance the budget, the City has proposed an 11.56% property tax increase.

According to the City, the tax hike will fund the replacement of old roads and end-of-life sewer lines, including the replacement of old drainage pipes under the Fraser Highway, which is expected to cost $18.2M. Additionally, the City plans to borrow $15M to strategically purchase property for development along the route of the upcoming Surrey-Langley SkyTrain extension of the existing Expo Line. The City aims to maximize this opportunity for the benefit of its residents and businesses.

However, councilors have acknowledged the need to reduce the tax burden and have taken the budget back to the drawing board. The final budget is expected to be approved by council on May 9th.

Port Moody

2023 Proposed Tax Increase: 11.33%

Status: Pending Approval

The City of Port Moody proposed an 11.33% property tax increase in its February budget, attributing the rise to inflation, increasing transportation costs, and operating expenses.

If approved, this tax hike would place Port Moody among the limited number of municipalities with a tax rate increase exceeding 10% this year.

Richmond

2023 Proposed Tax Increase: 5.89%

Status: Approved

Richmond took an early start to its budget deliberations and approved the 2023 budget and new property tax rate weeks ahead of Christmas.

The proposed tax increase in Richmond is expected to be lower than the inflation rate. Additionally, the City announced that there will be an additional 0.65% reduction as a result of Council’s approval to use the City’s rate stabilization account to alleviate budgetary pressures.

Coquitlam

2023 Proposed Tax Increase: 5.48%

Status: Approved

Coquitlam is expected to have a modest 5.48% property tax rate increase, unlike many other municipalities.

The City claims that the need for such an increase is beyond their control, as inflation has added about 4% to all City expenditures. However, Coquitlam aims to reduce the burden on taxpayers by maximizing non-tax revenue streams, such as development fees, and utilizing development to cover growth-related expenses.

Delta

2023 Proposed Tax Increase: 4.9%

Status: Approved

Delta took early action on its 2023 budget, approving the financial plan and new tax rate in early December with a meager increase of only 4.9%.

In addition to this, George Harvie, the Mayor of Delta, was appointed as the Chair of Metro Vancouver’s Board of Directors in December. One of his primary objectives is to establish a regional task force to investigate the growing expenses across Metro Vancouver.

Burnaby

2023 Property Tax Increase: 3.99%

Status: Approved

Despite being the third-largest municipality in Metro Vancouver and experiencing significant development in the Brentwood and Metrotown neighbourhoods, Burnaby residents will only face a minor 3.99% property tax increase this year – one of the smallest in the province. The City attributes this increase to the cost of water and sewer services passed down by Metro Vancouver, which only saw an actual increase in costs of 2.8% for water services and 7.6% for sewer services. Burnaby says it is managing this rate increase by using reserves to provide relief to taxpayers, which is even lower than the inflation seen in 2022. The City’s 2023-2027 Financial Plan was approved by Council on February 27.

While property tax increases are never welcome news for homeowners, they play an essential role in funding vital services and infrastructure projects that benefit the entire community. By staying informed about property tax rates and how they are determined, homeowners and homebuyers can make informed decisions when buying a home, know about their budgets and contribute to the growth and success of their municipality.